Press Release 59/June 22, 2022

Touted as an increase in school funding, a complicated change in how Dearborn Public Schools received state aid this fiscal year actually resulted in millions less for the district in per pupil funding.

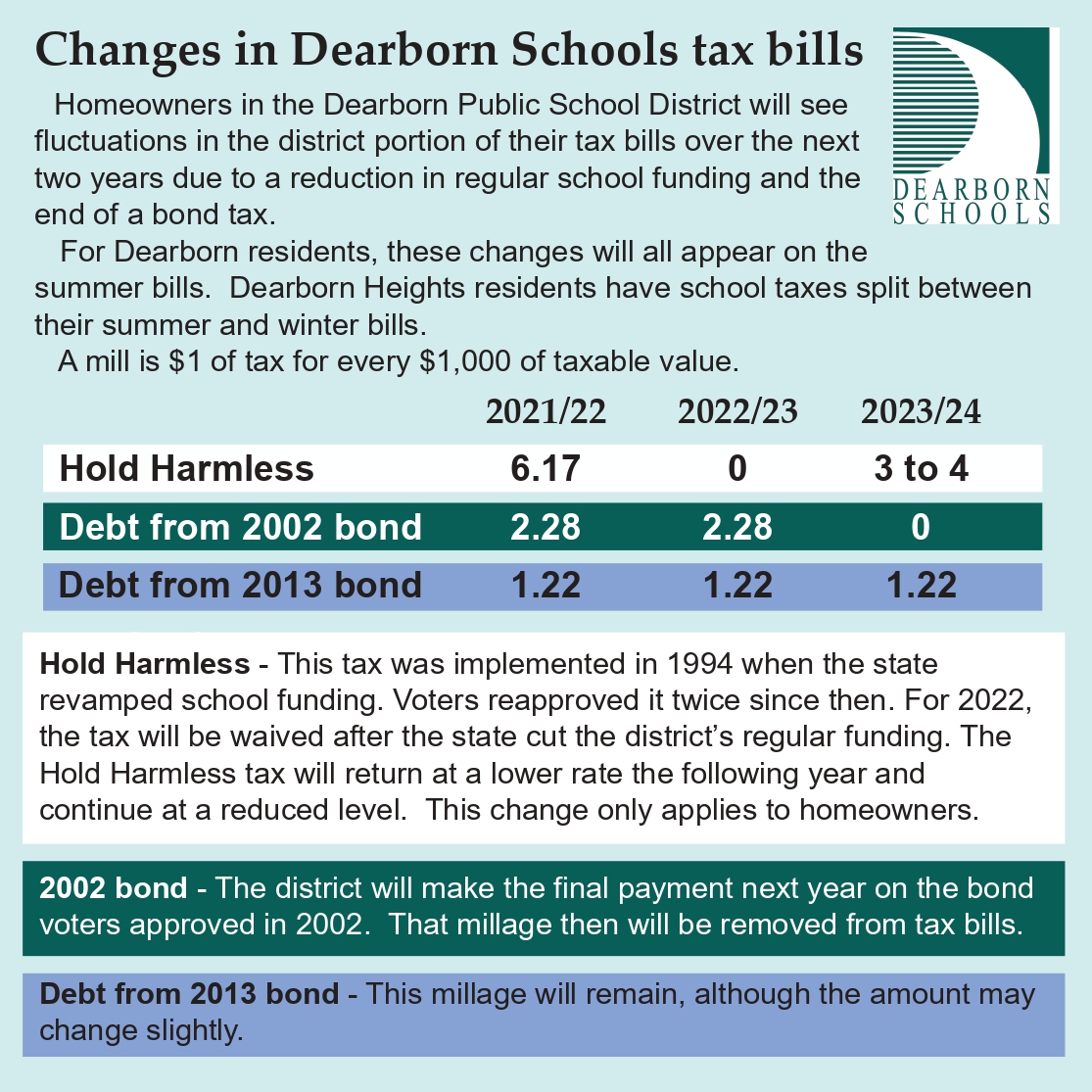

Local homeowners will benefit from the tax change with a dip in their property tax bill this summer followed by the return of a smaller millage in July 2023.

“This change caught us unaware since none of our contacts in the state initially realized it was part of the state’s budget,” said Tom Wall, Executive Director of Business Services and Operations. “We had budgeted for an increase in general fund revenue from the state but then discovered we actually were facing $4 million less in unrestricted revenue.”

While the district is still expecting tens of millions in additional COVID relief funding, that money can only be spent on very limited items. General fund dollars can cover any of the district expenses including salaries, utilities, supplies, etc.

The funding snafu relates to the district’s Hold Harmless millage. In 1994, when Proposal A passed to revamp school funding in Michigan, Dearborn and about 50 other districts around the state were allowed to continue a portion of their local property tax so they could keep the higher per pupil funding that district voters had approved in the past and now reapproved every 10 years. This sliver of funding is called the Hold Harmless millage.

Last year, legislators approved an $171 increase in per pupil funding, bringing Dearborn Public Schools to $8,951 per student. The increase resulted in an additional $3.4 million for the district.

However, buried in the code of the new state budget was a requirement that to receive the extra funding, the roughly three dozen districts like Dearborn that still had Hold Harmless millages had to reduce that tax. For Dearborn, the change meant a $7.4 million reduction in the amount the district was allowed to collect. Previously, the district was expected to collect $594 per student or up to 6.17 mills from the Hold Harmless tax. Now, the district is capped at $313 per student. That means a $171 per student increase in state funding cost Dearborn Schools a $281 per pupil decrease in Hold Harmless funding.

City of Dearborn residents pay all of their school taxes as part of their summer tax bill issued on July 1. So by the time the tax law was signed in late September 2022, those local tax payments had already been collected. Dearborn Heights residents have their school taxes divided evenly between the summer and winter tax bills.

To rectify what turned out to be an overcollection on the last tax bills, the district’s 6.17 mill Hold Harmless tax will not be on the property tax bills for district homeowners this year in Dearborn and Dearborn Heights. Non-Homestead properties will still pay the full 18 mills, although for this year they will not see the portion broken out for Hold Harmless.

Next year, the Hold Harmless will return, but at a lower rate, likely closer to 3 or 4 mills. The exact rate will be determined next year based on enrollment and total taxable value in the district.

Dearborn property owners may also notice that a 3.5 mill tax for the City of Dearborn is no longer on their tax bill after voters last fall refused to renew that operating tax at a lower 2.75 mill rate. The City of Dearborn and Dearborn Public Schools are separate entities and do not share any finances.

Fading bond taxes

While a reduced Hold Harmless millage will return on the summer 2023 bill, district residents will see another school tax fall off. A 2.28 mill tax for a bond approved in 2002 will be removed when that bond is paid off in the coming year. Another millage, currently 1.22 mill, will stay on the school tax bill for the next several years to pay off the bond voters approved in 2013. Homeowners can see a breakdown of the school portion of their tax bill in a tax graphic created by the district.

Other 2022-23 budget items

Information about the property tax change was presented as part of the Dearborn Public Schools 2022-2023 budget hearing on June 6. The budget for next fiscal year, which starts July 1, was approved at the June 20 Board of Education meeting.

As part of the approved budgets, the district was able to move $12 million into the building and site fund this year and plans to move $14 million into the fund next year. This is possible because of COVID relief funds through ESSERS, Wall told trustees. Some expenses, including salaries for certain positions like social workers, can be paid through ESSER funds, and that is allowing the district to then use those dollars in other areas. However, ESSER funding will go away in another two years, which means the district will need to continue to try to find ways to fund infrastructure needs.

ESSERS funds can only be used for certain expenses. The only infrastructure work allowed is related to improving heating and ventilation systems. Heating alone is not allowed, which means, for example, the funds cannot be used for much needed boiler replacements in some schools. The district is planning to spend about $40 million in ESSERs funds on HVAC work, most of it on air conditioning. (See the June 16, 2022 capital improvement plan for next fiscal year.) Current plans call for cooling systems to be added at eight elementary schools including DuVall, Long, Howard, Haigh, Nowlin, Oakman, Snow, and Whitmore Bolles. The average cost per building is projected to be more than $4 million. If construction costs continue to rise significantly, some buildings may be removed from the current work list. Work on the systems will begin over summer vacation, but installation is not expected to be completed until late 2023 or early 2024 due to the complex scope of the projects and supply chain concerns. Last year, the district did a study of infrastructure needs in its then 35 buildings for the next 10 years, including prioritizing the addition of air conditioning based on a number of factors.

The district also will set aside about $1.5 million of its fund balance towards infrastructure needs.

“We are being more aggressive because we have to start setting more aside for building and site,” Mr. Wall told trustees.

Meanwhile, the state still has not set school funding for next year. State revenues account for about 80 percent of the district’s general fund revenues. The governor, House and Senate all have different proposals, but each shows more funding for students.

The district’s total budget for next year will be $449 million, including ESSERs funding. General fund revenues make up $263 million of the total budget.

“Obviously our budget cannot be more than our best guess since we still do not know what funding we will get from the state, either in per pupil foundation allowance or in special categoricals, and state funding makes up the majority of our revenue,” Mr. Wall said.