Press Release #47/March 30, 2022

The Dearborn Public Schools Board of Education will continue their discussion on the possibility of a public bond vote in November after a citizens infrastructure committee overwhelmingly supported the need for a new bond.

The Vision for Infrastructure and Planning Committee (VIP) presented its report to the board during a special meeting on Wednesday, March 23, 2022. The 43-person citizens committee met six times from January to March to talk about infrastructure needs, school funding, and related issues.

Committee members Nofila Haidar and Rawa Albarkat presented the VIP Committee’s report to the board.

A poll showed 92 percent of committee members felt the district needed to go out for a new bond to help fund infrastructure work. Ninety seven percent of the committee felt the district should either maintain the current 3.5 mill tax rate (64 percent) or increase the tax rate (33 percent).

Trustees heard the report and asked a number of questions of committee members and administrators during March 23’s four hour meeting. While the board could wait until summer to approve a November bond question, administrators asked trustees to provide direction much sooner than that, including guidance on what types of projects to prioritize. An earlier decision would give the district more time to hone in on the exact projects that will be included in a bond and to share information with the public. Dearborn Public Schools has 35 buildings, holding 37 schools plus other programs.

The board decided to turn the meeting already scheduled for April 11 into a study session to talk more in depth about infrastructure and a possible bond question. The start time for the meeting was also moved up to 6 p.m. If needed, the board will then hold another special meeting on April 25 to continue the discussion and/or address regular business items postponed from the April 11 meeting.

Meanwhile, the board asked administrators to find more ways for residents to offer input on what they see as infrastructure priorities for the district. A community survey is being created, similar to a survey staff completed for the VIP committee. Parents and residents will be invited to fill out the form once it is available.

Also during the March 23 meeting, Tom Wall, Executive Director of Business Services and Operations, gave an overview of financial issues related to school bonds.

Issuing a new 20 year bond while keeping the current tax rate of 3.5 mills could generate about $200 million for the district. A mill is $1 of tax for every $1,000 of assessed value. The district’s tax rate for bonds has already fallen from 5.8 mills in 2013 as property values climbed and other school debts were paid off or refinanced for lower interest rates.

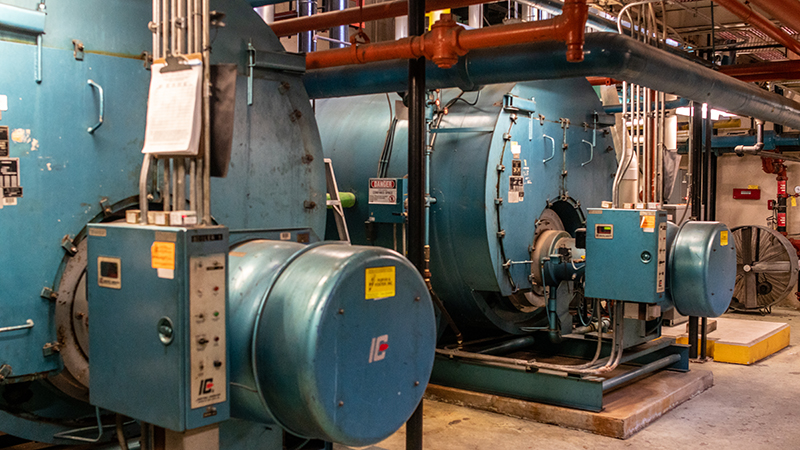

Mr. Wall’s report also showed the district has added more than $52 million for infrastructure work to its regular budget over the last two years. Most of that increase, $40 million, is being paid for directly from federal ESSER dollars. The only infrastructure work allowed with the COVID relief funding is for air-handling and related heating, ventilation and air-conditioning work, Mr. Wall explained. Next year’s budget will also include more infrastructure work funded directly or indirectly through COVID money. In total, the district expects to spend an extra $80 million on infrastructure work due to the extra funding.

Board members and Superintendent Glenn Maleyko thanked the committee members for their work looking at infrastructure issues in the district.

“I respect the committee process, and I respect that we have to make these decisions,” Dr. Maleyko said.

The committee met its mission of providing the board a macro view of the community’s interest for what general areas to prioritize and whether to pursue a bond, he said. Once the board provides more direction on how to prioritize projects, administrators, staff experts and outside consultants will draw up more specific plans for each building.

“These decisions we are making right now … are really for the next generation of students,” Dr. Maleyko said.